Why Your Business Requirements the Best Payroll Services in Singapore for Efficient Management

Why Your Business Requirements the Best Payroll Services in Singapore for Efficient Management

Blog Article

Navigating the Complexities of Pay-roll Conformity: Vital Solutions for Startups and Enterprises

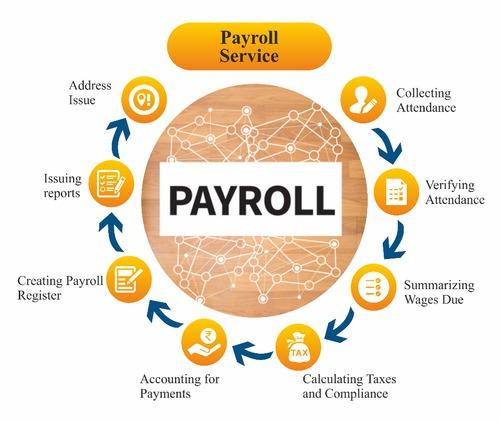

As services, despite dimension, aim to preserve compliance with ever-evolving payroll policies, the complexities of payroll management can frequently present challenges that need an eager understanding of lawful demands and precise attention to detail. Browsing the maze of pay-roll compliance is a crucial task that can significantly affect a firm's monetary stability and reputation. In today's vibrant business landscape, business and startups alike are increasingly turning to specialized solutions to enhance their payroll procedures and make sure adherence to complicated policies. The world of payroll compliance services provides a lifeline to businesses, encouraging proficiency, performance, and satisfaction in an area fraught with possible challenges.

Pay-roll Software Program Solutions

Carrying out efficient pay-roll software options is critical for organizations of all dimensions to enhance payroll procedures and make sure exact economic management. Payroll software application automates different tasks, including calculating incomes, withholding taxes, and producing tax obligation types. This automation reduces the chance of mistakes and saves time, enabling HR and money teams to concentrate on even more strategic tasks.

Picking the ideal pay-roll software program is crucial. Aspects to think about consist of scalability, integration with existing systems, user-friendliness, and customer assistance. Whether a start-up or a recognized venture, spending in a dependable pay-roll software application service can result in set you back financial savings, boosted accuracy, and total business success.

Compliance Consulting Services

Given the intricacy of payroll software application solutions and the ever-evolving landscape of tax legislations, organizations often look for out Conformity Consulting Services to ensure adherence to regulatory needs and best methods. Conformity Consulting Solutions supply important assistance to start-ups and ventures in browsing the intricate internet of payroll compliance. These solutions incorporate a variety of offerings, consisting of but not limited to conformity audits, plan advancement, danger evaluation, and regulative updates.

By involving Conformity Consulting Providers, services can proactively deal with possible compliance issues before they escalate right into costly problems. Specialists in this field have specialized understanding and expertise that can help organizations simplify their payroll procedures while alleviating conformity risks. Compliance Consulting Providers can supply tailored services that straighten with the particular demands and sector regulations influencing a company.

Basically, Conformity Consulting Services function as a tactical partner for companies seeking to preserve conformity, support ethical requirements, and adjust to the dynamic regulative environment. Leveraging these solutions can eventually protect a business's credibility and economic health over time.

Tax Filing Assistance

When navigating the complexities of tax obligation regulations and regulations, organizations usually rely upon specialist tax obligation filing help to ensure timely and precise entry of their economic files. Tax declaring assistance solutions supply invaluable support to start-ups and enterprises by assisting them browse the facility landscape of tax compliance. These services include a series of offerings, including preparing and submitting various tax return, computing tax obligation responsibilities, and ensuring adherence to altering tax regulations.

Expert tax declaring support guarantees that services meet their tax responsibilities while reducing the threat of errors or fines. By partnering with professionals in tax conformity, organizations can enhance their tax declaring procedures, maximizing time and resources to focus on core company tasks - Best payroll services in Singapore. In addition, these solutions can give support on tax obligation planning approaches to make best use of and maximize economic end results tax performance

In today's quickly progressing tax obligation environment, remaining certified with tax obligation legislations is vital for companies of all sizes. Tax obligation filing aid offers a trusted option for start-ups and business seeking to navigate the complexities of tax guidelines with self-confidence and precision.

Employee Category Support

Navigating the complexities of tax compliance usually entails not just looking for expert tax filing aid yet likewise making sure correct click site employee category assistance to keep regulative adherence and functional effectiveness. Staff member classification is an important facet of payroll conformity that figures out whether workers are identified as employees or independent professionals. This distinction is critical as misclassifying employees can cause serious financial penalties and legal ramifications for companies.

Employee category assistance services assist companies precisely categorize their workforce according to the appropriate regulations and guidelines. These solutions examine various aspects such as the degree of control, monetary setup, and kind of connection in between the organization and the employee to establish the appropriate category. By ensuring proper category, organizations can stay clear of conformity issues, decrease the risk of audits, and preserve a favorable partnership with their labor force.

Moreover, staff member classification assistance solutions supply advice on tax withholding, advantages eligibility, and various other conformity needs based upon the worker's classification. This assistance is specifically useful for start-ups and ventures aiming to navigate the intricacies of work policies while concentrating on their core business tasks. Best payroll services in Singapore. By leveraging staff member classification assistance solutions, companies can simplify their pay-roll procedures and mitigate the threat of non-compliance

Record-Keeping Tools

Reliable utilization of record-keeping tools is important for making sure accurate documents and compliance with payroll guidelines in both start-ups and established enterprises. These tools play a crucial duty in preserving arranged documents of employee info, incomes, tax withholdings, and various other important pay-roll information. In today's electronic age, many progressed pay-roll software application solutions use incorporated record-keeping attributes that simplify the process and decrease the danger of mistakes.

Final Thought

In verdict, the intricacies of payroll conformity require crucial solutions such as pay-roll software program options, conformity consulting services, tax declaring aid, employee classification assistance, and record-keeping tools. These solutions are vital for enterprises and startups to ensure they satisfy lawful needs and preserve precise pay-roll records. By making use of these tools and services, organizations can navigate the complex landscape of pay-roll compliance with performance and accuracy.

As organizations, regardless of size, make every effort to maintain compliance with ever-evolving pay-roll guidelines, the complexities of payroll administration can usually existing challenges that demand a keen understanding of lawful demands and precise attention to detail.Executing efficient pay-roll software options is essential for businesses of all dimensions to simplify payroll procedures and guarantee exact my website economic management.Offered the complexity of pay-roll software program solutions and the ever-evolving landscape of tax legislations, businesses often look for out Conformity Consulting Services to guarantee adherence to regulatory requirements and finest practices (Best payroll services in Singapore). Conformity Consulting Providers provide invaluable support to startups and business in browsing the elaborate internet of payroll conformity.In final thought, the complexities of pay-roll compliance require important solutions such as pay-roll software options, conformity consulting solutions, tax obligation filing assistance, employee category support, and record-keeping tools

Report this page